A 50% Price Drop Looms

<time itemprop="datePublished" content="2017-05-15T20:13:31Z">May.15.17</time> | About:

Ford Motor (F)

Value, dividend investing, Growth

<header>

</header>

Summary

Car sales have topped out.

Off-lease cars are flooding the used car market.

MS expects a used car price drop of up to 50% --

this would make new cars less attractive in comparison and would likely lead to sales declines for Ford.

Share price has dropped, thus some headwinds are likely priced in -- shares could remain stable even if sales and / or earnings drop.

Dividend looks secure as well as attractive.

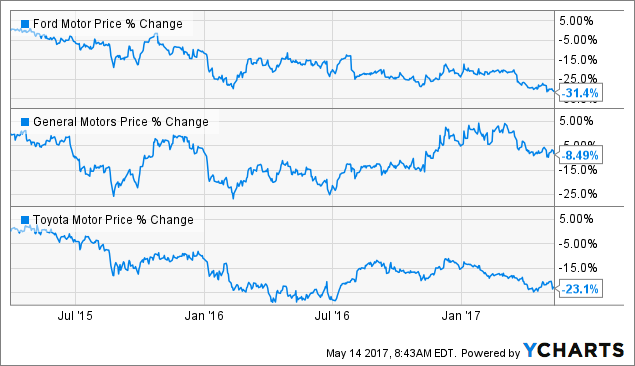

The auto industry saw shares drop significantly from cycle highs over the past, mainly due to worries about the number of new car sales.

Unfavorable conditions in the used-car market could pressure sales further, which doesn't bode too well for car manufacturers' shares.

F data by YCharts

Major car manufacturers saw their share prices drop by 23% (Toyota (NYSE:

TM)), 8% (General Motors (NYSE:

GM)) and

-31% (Ford (NYSE:F)) over the last two years, Volkswagen (

OTCPK:VLKAY), which was further pressured due to the diesel scandal the company is experiencing, is not included in this list.

This drop in Ford's share price (as well as the drop in the share prices of the other car manufacturers) are

based on fears about the US car market having peaked out for the time being.

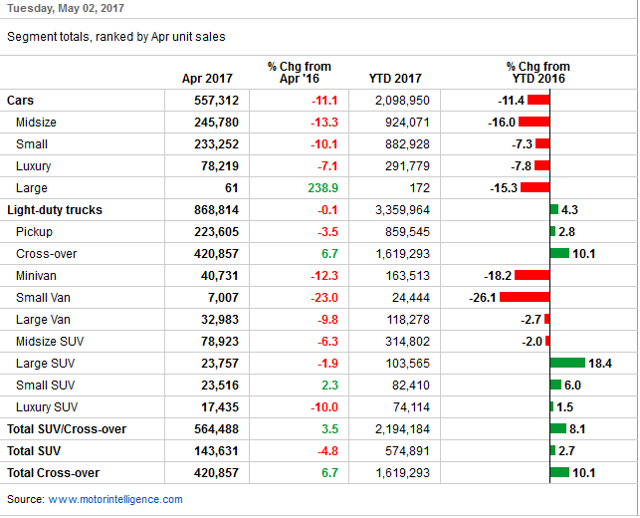

This (relative) weakness in the US car market is visible when we look at the most recent data, from April 2017:

The

WSJ reports that car sales

dropped 11% in April, with light-duty trucks not being able to off-set that decline due to a very small drop (0.1%) in that category as well. The smaller SUV/Cross-over market grew slightly, but is not big enough to make up for the decline in the other two categories.