Polaris Reports "Alarming" 2025 EPS Outlook As RZR & ATV Demand Slide

((Adjusted earnings per share (EPS) is a calculation that adjusts a company's earnings per share to account for unusual circumstances. It's a way to show a company's financial health more accurately by removing one-time gains and expenses.))Tuesday, Jan 28, 2025 - 07:45 AM

Polaris shares fell 6% in premarket trading after the company, known for producing ATVs, UTVs, jet skis, and snowmobiles, surprised investors with guidance for a 65% year-over-year decline in adjusted EPS for 2025, coming in far below expectations.

Citi analyst James Hardiman told clients earlier that the downward revision was very "alarming," warning about President Trump's tariff battle with China could result in additional downward pressure for EPS for the full year.

"While management suggested on their 3Q call that a good starting point for 2025 EPS would be flat with 2024, which was guided to $3.25, at the time, management officially initiated 2025 adjusted EPS guidance at just $1.10," Hardiman said, adding his team maintained a "Neutral" rating on PII shares.

Polaris' Yearly Forecast (courtesy of Bloomberg):

- Sees adjusted EPS about -65% from 2024's $3.25; estimate $3.06

- Sees sales -1% to -4%

Here's a snapshot of the fourth quarter:

- Sales $1.76 billion, -23% y/y, estimate $1.68 billion (Bloomberg Consensus)

- Off Road sales $1.44 billion, -25% y/y, estimate $1.36 billion

- On Road sales $180.8 million, -21% y/y, estimate $209.8 million

- Marine sales $137.4 million, -4.1% y/y, estimate $118.3 million

- Adjusted gross profit margin 21.1% vs. 20.8% y/y, estimate 21.3%

- Cash and cash equivalents $287.8 million, -22% y/y, estimate $397.8 million

- Adj. EPS 92c, estimate 90c

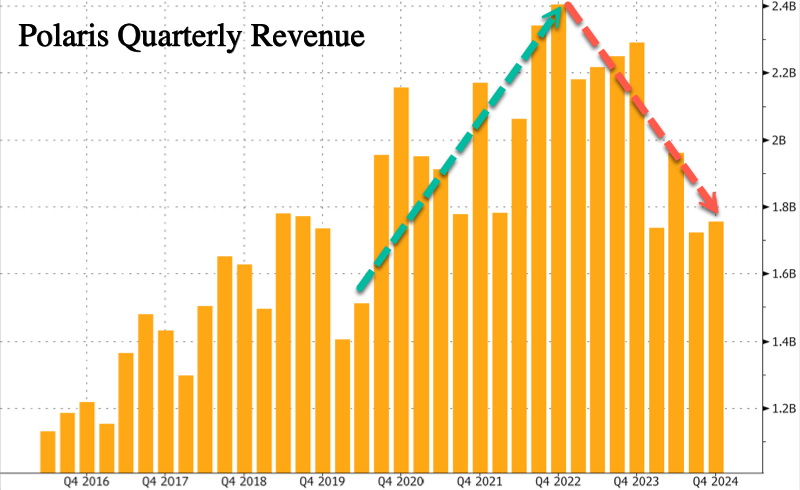

Polaris's YoY revenue growth is the worst since GFC.

Bloomberg noted:

- For 2025, expects margin headwinds from negative mix, planned reductions in production leading to negative absorption in addition to the restoration of the company's employee profit- sharing program

- Primary factors affecting fourth-quarter sales were lower volume due to planned reductions in shipments as we actively managed dealer inventory in a subdued retail environment

Bottoming fishing is a dangerous game...

Several months ago, Polaris CEO Mike Speetzen warned that "consumer confidence and retail demand remained challenging."

Polaris Reports "Alarming" 2025 EPS Outlook As RZR & ATV Demand Slide | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero