Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Colorado income tax?

- Thread starter dejadoo

- Start date

I am no expert but if your income is generated in the state of Indiana they will continue to tax your income there.

Any bank savings interest or any 1099 type asset will be taxed in your state of residence. (Colorado)

Any bank savings interest or any 1099 type asset will be taxed in your state of residence. (Colorado)

I agree with PJ. The Colorado Democrats will take you for everything they can get their hands on.

I don't know what Indiana does for income tax, but if Indiana taxes your income, then you should be able to deduct that from your Colorado filing to show that it was already taxed. But if Indiana doesn't tax it, then Colorado will tax it.

I'm not 100% certain how it works, but I have income from Colorado and from Utah; when I file my taxes for Colorado, I have to show that my Utah income was already taxed, then I don't have to pay double tax.

I don't know what Indiana does for income tax, but if Indiana taxes your income, then you should be able to deduct that from your Colorado filing to show that it was already taxed. But if Indiana doesn't tax it, then Colorado will tax it.

I'm not 100% certain how it works, but I have income from Colorado and from Utah; when I file my taxes for Colorado, I have to show that my Utah income was already taxed, then I don't have to pay double tax.

I know that I will have to pay Indiana tax,

but when I read the Colorado part time resident form

it says to include income made while living in Colorado.

Since I own a business, I could(hopefully anyway) make money in

Indiana while living in Colorado.

Probably will have to call a tax place in CO

but when I read the Colorado part time resident form

it says to include income made while living in Colorado.

Since I own a business, I could(hopefully anyway) make money in

Indiana while living in Colorado.

Probably will have to call a tax place in CO

That's funny, I was thinking of changing my residence to WY! I'm tired of paying state taxes.

Bingo - we have a winner.

That's funny, I was thinking of changing my residence to WY! I'm tired of paying state taxes.

I would if I were you. License you rig there too.

when your out this year let me know. I always wanted to explore pitkin.

Its only about a hour or so from our place.

Its only about a hour or so from our place.

when your out this year let me know. I always wanted to explore pitkin.

Its only about a hour or so from our place.

I wiil let you know, my 1st trip should either be the week before or after Christmas. I usully ride with Harmon, so if he comes along, it will be exploring.

S

Summit 800

Well-known member

I am considering changing my residence to Colorado,

but would still be making all my income in another state(Indiana).

Anyone know how Colorado deals with out of state income?

thanks

Disclaimer: This is not tax advice. I was hoping a real tax accountant would chime in but here goes....

I think that you file a tax return as a non resident in the state you earned the income and then file a tax return as a resident where you live. The resident state calculates your tax on all income and then gives you a credit for taxes paid elsewhere. So, as others have said, the tax man will get you some how....

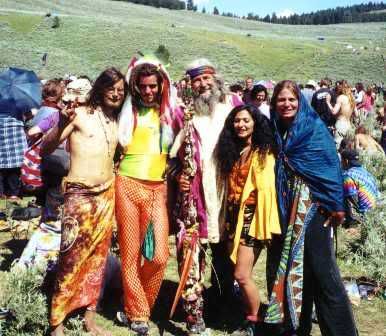

There's no trees at 12,000 feet stop lyingView attachment 85888

Wyoming would be a good idea for taxes, but if I buy a place there

I would have to sell my future cabin site at 12,000 ft

Awesome post ItDoAble

By the way, wouldn't mind hooking up with the NCTR, shoot me a pm if WY bumpkins are allowed to hit the trails with you guys.

As for State Income Tax, what's that?

By the way, wouldn't mind hooking up with the NCTR, shoot me a pm if WY bumpkins are allowed to hit the trails with you guys.

As for State Income Tax, what's that?

Similar threads

M

- Replies

- 8

- Views

- 3K

- Replies

- 11

- Views

- 3K

B

T

- Replies

- 23

- Views

- 867